Proposition 2 1/2 Override Questions and Answers

On this page we have listed a lot of detailed information on Proposition 2½ and how it works. Recognizing that some readers may be interested in more in the impact to their taxes, here is the tax impact for the average home in West Boylston (please see detailed information below under the heading "How Much More will I Pay in Taxes if the Override Passes?"):

- West Boylston Fiscal Year 2024 Average Single Family Assessed Value: $467,342.00

- West Boylston Fiscal Year 2024 Average Single Family Tax Bill: $6,907.00

- Tax Increase for the first $600,000.00 of a $4M override (Fiscal Year 2025 Impact): $191.61 in addition to the $6,907.00

- Tax Increase if the Town were to utilize the entire $4M override in Fiscal Year 2025 (this is not being proposed, details below under the heading "How Much More will I Pay in Taxes if the Override Passes?": $1,285.19 in addition to the $6,907.00

More detailed tax impact information is located about three quarters of the way down the page.

What is Proposition 2½? (Click Here for a Short Video)

Proposition 2½, approved by Massachusetts voters in 1980 and first implemented in fiscal 1982, limits the amount of revenue a city or town may raise, or levy, from local property taxes each year to fund municipal operations. The law (M.G.L. Ch. 59, Sect. 21C) places two constraints on the amount of property taxes a city or town can levy:

- A community cannot levy more than 2.5 percent of the total full cash value of all taxable property in the community (called the levy ceiling).

- A community’s allowable levy for a fiscal year (called the levy limit) cannot increase by more than 2.5 percent of the maximum allowable limit for the prior year, plus certain allowable increases such as new growth from property added to the tax rolls.

What is a Levy?

The property tax levy is the revenue a community can raise through real and personal property taxes. We will refer to the property tax levy simply as the levy. In Massachusetts, municipal revenues to support local spending for schools, public safety and other public services are raised through the property tax levy, state aid, local receipts and other sources. The property tax levy is the largest source of revenue for most cities and towns.

What is a Levy Ceiling? What is a Levy Limit?

Proposition 2½ places constraints on the amount of the levy raised by a city or town and on how much the levy can be increased from year to year. A levy limit is a restriction on the amount of property taxes a community can levy. Proposition 2½ established two types of levy limits: First, a community cannot levy more than 2.5 percent of the total full and fair cash value of all taxable real and personal property in the community- the levy ceiling. Second, a community’s levy is also constrained in that it can only increase by a certain amount from year to year- the levy limit. The levy limit will always be below, or at most, equal to the levy ceiling. The levy limit may not exceed the levy ceiling. Proposition 2½ does provide communities with some flexibility. It is possible for a community to levy above its levy limit or its levy ceiling on a temporary basis (debt exclusion), as well as to increase its levy limit on a permanent basis (override).

How is a Levy Ceiling Calculated? (Click Here for a Short Video)

The levy ceiling is determined by calculating 2.5 percent of the total full and fair cash value of taxable real and personal property in the community:

- Full and Fair Cash Value x 2.5% = LEVY CEILING

- Full and Fair Cash Value = $100,000,000

- $100,000,000 x 2.5% = $2,500,000

In this example, the levy ceiling is $2,500,000.

How is a Levy Ceiling Changed?

The total full and fair cash value of taxable real and personal property in a community usually changes each year as properties are added or removed from the tax roll and market values increase or decrease. This also changes the levy ceiling.

How is a Levy Limit Calculated? (Click Here for a Short Video)

A levy limit for each community is calculated annually by the Department of Revenue. It is important to note that a community’s levy limit is based on the previous year’s levy limit and not on the previous year’s actual levy. Each step in the example below is detailed in other sections of this primer. A levy limit is calculated by:

This community’s levy limit, the maximum amount in real and personal property taxes it can levy, is $1,140,000 for FY2008. How much of this amount the community actually wants to use — that is, the amount of the levy — is up to the discretion of local officials. The community can levy up to or at any level below the entire levy limit amount, regardless of what its levy was in the previous year.

How is a Levy Limit Increased?

The levy limit is increased from year to year as long as it remains below the levy ceiling. Permanent increases in the levy limit result from the following:

- Automatic 2.5 percent increase. Each year, a community’s levy limit automatically increases by 2.5 percent over the previous year’s levy limit. This does not require any action on the part of local officials; the Department of Revenue calculates this increase automatically.

- New Growth. A community is able to increase its levy limit each year to reflect new growth in the tax base. Assessors are required to submit information on growth in the tax base for approval by the Department of Revenue as part of the tax rate setting process.

- Overrides. A community can permanently increase its levy limit by successfully voting an override. The amount of the override becomes a permanent part of the levy limit base.

How Can a Community Levy Taxes in Excess of its Levy Limit or Levy Ceiling?

A community can assess taxes in excess of its levy limit or levy ceiling by successfully voting a debt exclusion or capital outlay expenditure exclusion. The amount of the exclusion does not become a permanent part of the levy limit base, but allows a community to assess taxes for a certain period of time in excess of its levy limit or levy ceiling for the payment of certain debt service costs or for the payment of certain capital outlay expenditures.

What is New Growth? (Click Here for a Short Video)

Proposition 2½ allows a community to increase its levy limit annually by an amount based on the increased value of new development and other growth in the tax base that is not the result of revaluation. The purpose of this provision is to recognize that new development results in additional municipal costs; for instance, the construction of a new housing development may result in increased school enrollment, public safety costs, and so on. New growth under this provision includes:

- Properties that have increased in assessed valuation since the prior year because of development or other changes.

- Exempt real property returned to the tax roll and new personal property.

- New subdivision parcels and condominium conversions. New growth is calculated by multiplying the increase in the assessed valuation of qualifying property by the prior year’s tax rate for the appropriate class of property. Any increase in property valuation due to revaluation is not included in the calculation.

What is an Override? (Click Here for a Short Video)

Proposition 2½ allows a community to assess taxes in excess of the automatic annual 2.5 percent increase and any increase due to new growth by passing an override. A community may take this action as long as it is below its levy ceiling, or 2.5 percent of full and fair cash value. An override cannot increase a community’s levy limit above the level of the community’s levy ceiling. When an override is passed, the levy limit for the year is calculated by including the amount of the override. The override results in a permanent increase in the levy limit of a community, which as part of the levy limit base, increases at the rate of 2.5 percent each year. A majority vote of a community’s selectmen allows an override question to be placed on the ballot. Override questions must be presented in dollar terms and must specify the purpose of the override. Overrides require a majority vote of approval by the electorate.

How Much is the Override that has been Proposed?

The total override that is being proposed is 4 million dollars. This is a general operational override split equally between the Municipal Government and Public Schools.

Why Is West Boylston Proposing an Override?

The Town of West Boylston and West Boylston Public School budgets each have structural deficits as each rely on one-time funds to balance the budget as opposed to solely relying on recurring revenue streams. Further, the cost of operations continue to outpace available revenues and without an override these deficits will grow and service cuts will be required. Over the recent years significant increases have been seen in health insurance, retirement, contractual obligations, and supplies. This override is designed to provide level services to the community while taking into account the expected cost increases to provide these services over the next five years.

How Much More will I Pay in Taxes if the Override Passes?

Although a 4 million dollar override is being presented, we do not intend to immediately increase the budget by 4 million dollars. As a reminder, this override is designed to cover the next five years. If the override passes then in Fiscal Year 2025 we are proposing to use an additional $600,000. $300,000 will be added to the public school budget and $300,000 of free cash will no longer be used to balance the overall budget. In subsequent fiscal years Town Meeting may authorize additional appropriations from the 4 million dollars, if the override is approved.

Below you will find a chart showing how much property taxes will increase if taxes are raised by $600,000 this year. In order to find the estimated impact to your family, follow the row most closely associated with your assessed value (directions below on locating your assessed value). You will also see a chart showing the full impact of a 4 million dollar override.

To find the assessed value of your home, visit the Assessor's page here. In the blue search bar located at the top left of the map, type in your address to find your property. Then click on "Vision Property Card" to pull up your property card. Here is an example of a property card showing the location of your current assessed value:

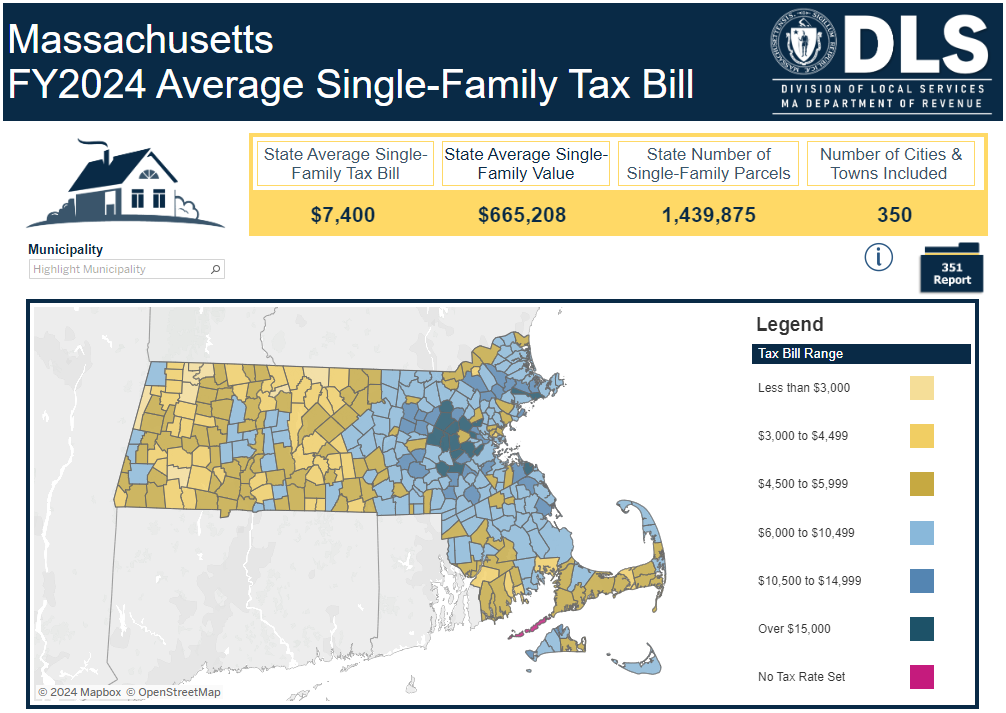

How Do West Boylston's Taxes Compare with the Rest of the State? How about our Neighbors?

Massachusetts FY2024 Average Single-Family Tax Bill

Single Family Tax Bill of Nearby Towns

What Happens if the Override Does Not Pass?

If the override does not pass for Fiscal Year 2025 the Town and the Schools will continue to rely on non-recurring revenues to balance the respective budgets resulting in a structural deficit. However, if an override does not pass for Fiscal Year 2026 it is predicted that cuts will be likely.

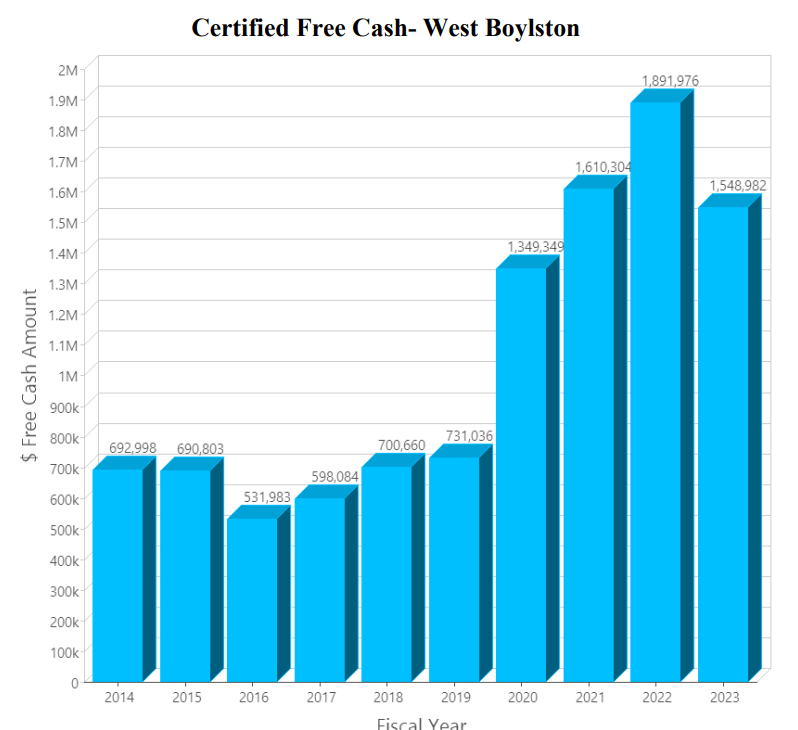

Why Can't We Use Free Cash to Fix the Budget?

Free cash is a revenue source that results from the calculation, as of July 1, of a community's remaining, unrestricted funds from its operations of the previous fiscal year based on the balance sheet as of June 30. It typically includes actual receipts in excess of revenue estimates and unspent amounts in departmental budget line items for the year just ending, plus unexpended free cash from the previous year. Free cash is offset by property tax receivables and certain deficits, and as a result, can be a negative number. Under sound financial policies, a community strives to generate free cash in an amount equal to three to five percent of its annual budget.

As a nonrecurring, and unpredictable revenue source, free cash should be restricted to paying one-time expenditures, funding capital projects, or replenishing other reserves.

Below is a chart showing West Boylston's free cash trends over the last ten fiscal years demonstrating how drastically the amount of free cash can differ from one year to the next.

Where Can I find Out More?

In addition to information about Town Meeting that will be posted to the Town Website here, you can attend the Budget Informational Public Forum that is being hosted by the Finance Committee on May 13, 2024 at 6:00 p.m at the Senior Center. While this Forum is not about the override per se, it will be helpful to understanding different elements of the budget as well as historical trends.

Resources: www.mass.gov/dls; www.mma.org